As someone who has been around the retirement industry for 20+ years, I have zero faith in most people saving for retirement unless they are forced to save. Right now, social security is it. The majority of people can't be fiscally responsible at a young age, which is key to retirement savings. Auto enrollment has helped a lot but there is still issues with people using their 401k as a non retirement slush fund.

No forums found...

Site Related

Iowa State

College Sports

General - Non ISU

CF Archive

Install the app

Retirement Targets

- Thread starter yowza

- Start date

No forums found...

Site Related

Iowa State

College Sports

General - Non ISU

CF Archive

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Yeah I understand but on a gut level I just don’t like the means testing of retirees and would prefer raising the cap on incomes taxed for SS.Why not just means testing with a sliding reduction scale like I proposed? Seems so much cleaner and easier. The wealthy would get nothing from what they pay and those in financial trouble would get the most help.

I think just raising the cap might be enough to solve the problem, since higher earners already put far more into the system than they get out in benefits (we’ve been through this in a previous discussion - SS benefits are already structured to be progressive)

Also, means testing pretty directly disincentivizes saving

The concept of time when you are say 22 just seems so far into the future. You have all the time in the world.As someone who has been around the retirement industry for 20+ years, I have zero faith in most people saving for retirement unless they are forced to save. Right now, social security is it. The majority of people can't be fiscally responsible at a young age, which is key to retirement savings. Auto enrollment has helped a lot but there is still issues with people using their 401k as a non retirement slush fund.

All the bombardment from social media and tv and from friends who do the YOLO stuff.

You do understand that benefits are capped today right?

And the earnings subject to tax today are capped. I plan on uncapping the benefits when the earnings taxed are uncapped.

The solution will pretty much solve SS problems. Algorithm used to determine benefits is progressive. Or everyone can give up 36 monthly SS checks. Do you want to give up 36 monthly SS checks so the super wealthy can continue to avoid the tax above the present threshold………which they will get benefits for?

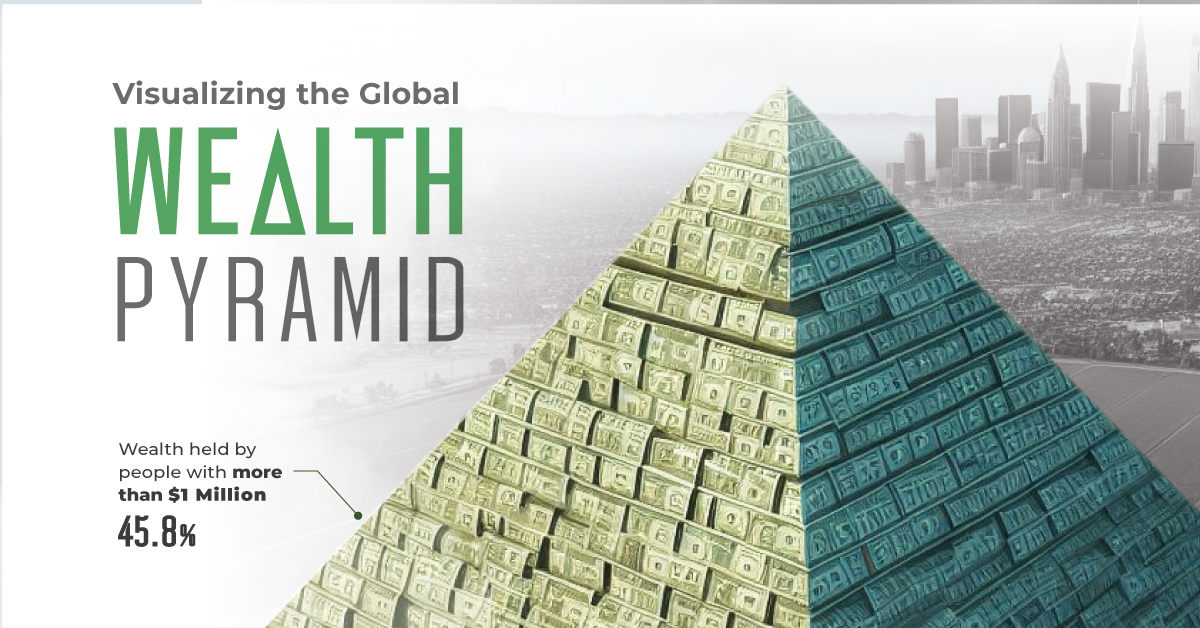

Visualizing the Pyramid of Global Wealth Distribution

Global wealth stands at over $454 trillion. This graphic shows how it's distributed, by various levels of net worth.

www.visualcapitalist.com

www.visualcapitalist.com

The Distribution of Global Wealth

Worldwide net private wealth stood at $454.4 trillion in 2022.Here’s how it was distributed across various levels of net worth, which takes a person’s financial and real assets such as housing, and subtracts their debt:

| Net Worth | Number of Adults | Share of Adults | Total Wealth | Share of Global Wealth |

|---|---|---|---|---|

| More than $1 million | 59.4M | 1.1% | $208.3T | 45.8% |

| $100,000 to $1 million | 642.0M | 12.0% | $178.9T | 39.4% |

| $10,000 to $100,000 | 1.8B | 34.4% | $61.9T | 13.6% |

| Less than $10,000 | 2.8B | 52.5% | $5.3T | 1.2% |

The highest wealth rung controls $208.3 trillion in wealth, or 45.8% of the global total. Just 1.1% of the world adult population fall in this bracket.

Those with $100,000 to $1 million have the next greatest share, at 39.4% of net household wealth.

We can see that wealth ownership begins to decline dramatically in the next bracket. People with $10,000 to $100,000 control just 13.6% of global wealth. However, the number of people in the global middle class have more than doubled over the last two decades, driven by the rapid expansion of China.

I'm not saying that something shouldn't be done or the amount raised. I just don't think that anyone has actually ran the numbers to see how well it would work with no caps on the benefits. If you have those stats, I'd love to see it.And the earnings subject to tax today are capped. I plan on uncapping the benefits when the earnings taxed are uncapped.

The solution will pretty much solve SS problems. Algorithm used to determine benefits is progressive. Or everyone can give up 36 monthly SS checks. Do you want to give up 36 monthly SS checks so the super wealthy can continue to avoid the tax above the present threshold………which they will get benefits for?

I'm not saying that something shouldn't be done or the amount raised. I just don't think that anyone has actually ran the numbers to see how well it would work with no caps on the benefits. If you have those stats, I'd love to see it.

Here is an article discussing it. You should try Google.

From the article:

In 2023, the tax cap stands at $160,200, which means any income above that amount is exempt from the payroll tax. As a result, middle- and lower-income workers bear a much greater tax burden in funding Social Security than the 6% of Americans who earn above the threshold, according a new analysis from the left-leaning Center for Economic and Policy Research.

"If you make over that cap, like 6% of the population does, you could be paying 1% of your income or even less than that," noted Sarah Rawlins, program associate at CEPR.

Yet a middle-income worker earning less than the $160,200 cap in 2023 will pay an effective tax rate that is six times higher than the millionaire's tax burden, she noted.

One way to fix Social Security? "Smash the cap"

Eliminating or lifting the tax cap would help stabilize Social Security, while also being fairer to most Americans, experts say.

As a fed employee SS is part of my retirement equation and by extension every congress critter when civil service pensions went away. So no congress critter is going to jump for reduction of SS benefits particularly the lesser known short timers. There are a handful that it wouldn’t matter.Yep. If social security is a poverty insurance program, Then you got insurance incase you, your spouse, or child could not provide essential needs later in life or you died or was disabled.

I think the one thing that people seem to keep forgetting is, this isn’t a retirement program, it’s a safety net. If it’s a safety net, then means testing with basic thresholds like poverty level and median household income make sense.

The devil is in the details.....Here is an article discussing it. You should try Google.

From the article:

In 2023, the tax cap stands at $160,200, which means any income above that amount is exempt from the payroll tax. As a result, middle- and lower-income workers bear a much greater tax burden in funding Social Security than the 6% of Americans who earn above the threshold, according a new analysis from the left-leaning Center for Economic and Policy Research.

"If you make over that cap, like 6% of the population does, you could be paying 1% of your income or even less than that," noted Sarah Rawlins, program associate at CEPR.

Yet a middle-income worker earning less than the $160,200 cap in 2023 will pay an effective tax rate that is six times higher than the millionaire's tax burden, she noted.

One way to fix Social Security? "Smash the cap"

Eliminating or lifting the tax cap would help stabilize Social Security, while also being fairer to most Americans, experts say.www.cbsnews.com

"Sections 6 and 7. Apply the combined OASDI payroll tax rate on earnings above $250,000,

effective for 2024 and later. Tax all earnings once the current-law taxable maximum exceeds

$250,000. Do not credit the additional taxed earnings for benefit purposes."

I don’t know that this would work exactly, but I don’t mind the general direction you are going in. Don’t they know how much a person has in tax deferred accounts (to calculate your required minimum distribution)? I would say use that as your calculus. If someone is above a certain threshold, begin a phaseout until you get nothing. I’d even support a credit for charitable contributions (so that if you were above the threshold but are generous, you still qualify). I like it as essentially an assist for the lower income folks and a backstop for anyone else (in case they run into major medical issues or whatever).Honestly, if it’s to keep people from being totally destitute, why should someone over median income get anything from it.

Looking at numbers. Poverty is around 21k. Median is 75k. So make the payment 1750/month and it becomes 0 at 75k. It would do what the program was created for.

The devil is in the details.....

"Sections 6 and 7. Apply the combined OASDI payroll tax rate on earnings above $250,000,

effective for 2024 and later. Tax all earnings once the current-law taxable maximum exceeds

$250,000. Do not credit the additional taxed earnings for benefit purposes."

Several options have been discussed. Including the one that gives full benefits. We need to raise the cap on earnings. And stock options should be taxed as well.

You are not using life expectancy correctly though. If it was 63 then because lots of children were dying (polio, measles, etc.) it is a meaningless number as far as social security goes. What would actually be useful is maybe the life expectancy of a 40 year old then and now as they would be moving into their peak earning years. If a 40 year old's life expectancy was say, 70 then and 80 now, that would be a lot longer to be collecting benefits. My guess is the difference isn't nearly that much though.When it was started the life expectancy was 63 years old. What it was started for and what it is now are two different things.

Investing your contributions, with some guardrails, would be awesome. Unfortunately, that would never pass thru Congress.

When you find the study where they actually include full benefits, I'd love to see that. The one they reference in this article as well as Bernie's doesn't, and that's a really big deal with the bottom line.Several options have been discussed. Including the one that gives full benefits. We need to raise the cap on earnings. And stock options should be taxed as well.

At my age and income level, i'd love to see this done but like most things in Washington, the fine print isn't brought up.

When you find the study where they actually include full benefits, I'd love to see that. The one they reference in this article as well as Bernie's doesn't, and that's a really big deal with the bottom line.

At my age and income level, i'd love to see this done but like most things in Washington, the fine print isn't brought up.

Many proposals out there. I’ll Google it.

And if we do cap benefits that Is preferable to making everyone else lose 36 monthly SS checks just because a super rich guy doesn’t care about the average person.

Last edited:

OK, I have to call out the bolded as highly and deliberately misleading.Here is an article discussing it. You should try Google.

From the article:

In 2023, the tax cap stands at $160,200, which means any income above that amount is exempt from the payroll tax. As a result, middle- and lower-income workers bear a much greater tax burden in funding Social Security than the 6% of Americans who earn above the threshold, according a new analysis from the left-leaning Center for Economic and Policy Research.

"If you make over that cap, like 6% of the population does, you could be paying 1% of your income or even less than that," noted Sarah Rawlins, program associate at CEPR.

Yet a middle-income worker earning less than the $160,200 cap in 2023 will pay an effective tax rate that is six times higher than the millionaire's tax burden, she noted.

One way to fix Social Security? "Smash the cap"

Eliminating or lifting the tax cap would help stabilize Social Security, while also being fairer to most Americans, experts say.www.cbsnews.com

First it's 6% are over the cap - that includes people making $160,500. But to pay 1% of your income as FICA, you would need to make 6 times the cap, i.e. 960k annually in WAGES. Not cap gains, not interest/dividends, not gambling winnings- WAGES. That's a hell of a "could" caveat in that sentence.

Then the second bolded turns that into a "will pay 6 times higher" and that is total BS. Highly misleading, not cool by the author.

Sorry, number nerd, can't help myself.

OK, I have to call out the bolded as highly and deliberately misleading.

First it's 6% are over the cap - that includes people making $160,500. But to pay 1% of your income as FICA, you would need to make 6 times the cap, i.e. 960k annually in WAGES. Not cap gains, not interest/dividends, not gambling winnings- WAGES. That's a hell of a "could" caveat in that sentence.

Then the second bolded turns that into a "will pay 6 times higher" and that is total BS. Highly misleading, not cool by the author.

Sorry, number nerd, can't help myself.

Does not deflect from the fact that the millionaire wage earner pays a lower marginal rate of tax than a middle income worker.

Eliminate the cap on all earned wages for SS tax.

You can’t create a system that disincentivizes savings. It will have a massive negative impact on the stock market and likely lead to worse inflation than we just saw the last 3 years. Double digit interest rates will follow.Nope.

For a two person household who worked 120 quarter each, the minimum amount they would get is roughly 2125 per month.You can’t create a system that disincentivizes savings. It will have a massive negative impact on the stock market and likely lead to worse inflation than we just saw the last 3 years. Double digit interest rates will follow.

So are you saying that the current SS deincentivizes saving?

Flat tax. Everyone pays the same %. Do it for all income taxes as well.Does not deflect from the fact that the millionaire wage earner pays a lower marginal rate of tax than a middle income worker.

Eliminate the cap on all earned wages for SS tax.

Flat tax. Everyone pays the same %. Do it for all income taxes as well.

No. Just eliminate SS earnings cap. Completely. Start taxing stock options for SS. Middle Class prefers this option versus losing 36 monthly SS checks. Why do you want people to suffer to give the wealthy tax breaks?